Introduction

The PRSA, pursuant to the 2011 Act, made Regulations, known as the Property Services (Regulation) Act 2011 (Client Monies) Regulations 2012 (―the Regulations ), which came into operation on 11th June 2012. The Regulations set out the requirements of Property Service Providers (PSPs) with regard to the keeping of client monies etc. These include but are not limited to :

- Ensure that no payment, other than money for a client is placed in the Client Account.

- Keep proper accounting records detailing information regarding monies received or held for, or paid to or on behalf of, each client.

- The Licensee shall not withdraw money from a client account except subject to the amount of monies withdrawn not exceeding the total of the monies held for the time being in the client account on behalf of the client concerned.

- Ensure that no debit balance occurs on the Client Ledger account in respect of clients, other than a debit balance which is fully offset by a credit balance arising from another client’s ledger account in respect of the same client.

- Not holding moneys to which the PSP is entitled to in the client accounts for longer than one month.

- Hold in the Client Account only Client’s monies.

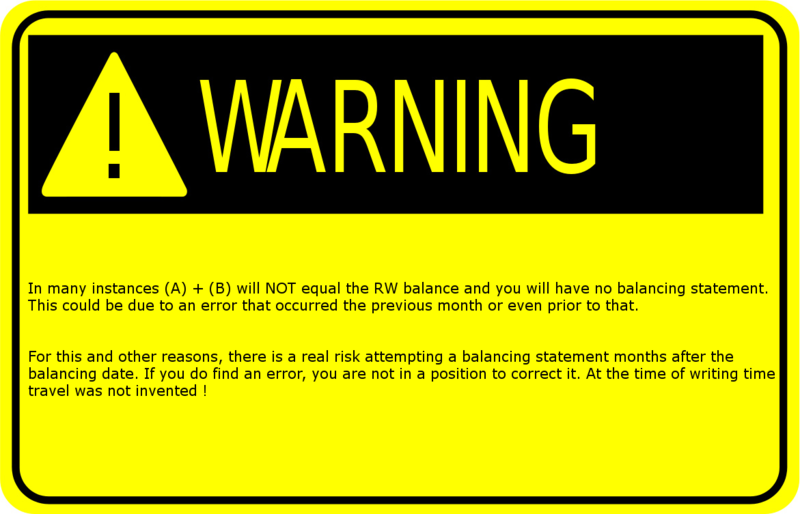

- Complete a Balancing Statement not later than 2 months after the balancing date to which it relates.

The balancing statement is the basis for the audit report for your licence renewal and also for the client account balance for your year end accounts.

If you do not prepare the balancing statement in a timely manner it is impossible to correct a deficit arising from a breach or error in a timely manner and your auditor will have no option but to report the breach unless it is minor.

These balancing statements will form the basis of the Audit / Accountant’s Report so it is important that you understand what they are and how to produce them at least once a month.

Who is responsible for what ?

- The 2011 Act requires the furnishing of an Accountant‘s Report in a specified format to accompany the application for a new business license and in the application for a renewal of license.

- The PSP ( you ) is responsible for the bookkeeping.

- The accountant ( auditor ) is responsible for carrying out an examination of the PSP’s accounting records and for producing an Accountant’s Report regarding the PSP’s compliance with the Regulations for the relevant period.

Regulation 10 governs the requirement of relevant PSPs to maintain accounting records. Particular attention is drawn to the following:

- Paragraph (1) requires that a relevant PSP ―shall in the course of and arising from the provision of property services, maintain as part of his or her accounting records proper books of account and such relevant supporting documents as will enable client monies handled and dealt with by the licensee to be duly recorded and the entries relevant thereto in the books of account to be appropriately and properly vouched.

- Paragraph 5(a) obliges a relevant PSP to prepare a ‘balancing statement‘ at each balancing date (6 months after commencement of the relevant accounting period and the end of the accounting period), balancing the total credit balances on the client ledger account with the balance on the client ledger control account and the client account bank statements. These balancing statements should be prepared no later than 2 months after the balancing date to which they relate.

According to the Consultative Committee of Accountancy Bodies - Ireland .. Accountant / Auditors should design procedures on a sample basis to test the PSP‘s compliance with each of the Regulations. The work required in reporting under the Regulations is extensive. However, it does not amount to an audit of the PSP‘s accounts.

What is a Balancing statement ?

Simply put :

(A) + (B) = (C)

Where :

(A) = The Client Account Composition Report from your accounting system

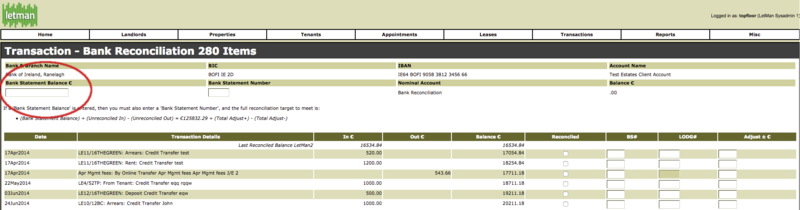

(B) = A Bank Reconciliation for the particular date.

(C) = The Real World ( RW ) Client Bank Account Balance at a particular date.

When should a Balancing statement be prepared ?

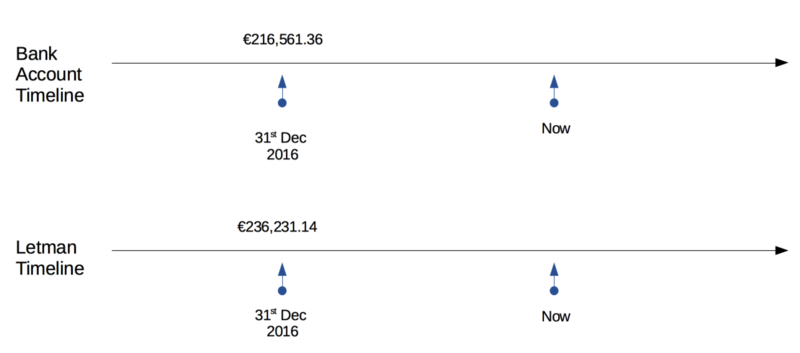

We can answer that by saying when it should NOT be done, and that is 6 months after the balancing date. As you can see from the graphic, the Letman Balance at the balancing date ( in this example 31st Dec 2016 ) is not the same as the Bank Balance in the real world. It rarely will be and for the following reasons

1. Payments from Letman ( say remittances to landlords ) or payments to Creditors may have reduced the Letman balance but not yet cleared the bank account. These payments could have been made hours, days, weeks before the required Balancing Date.

2. Rents received to the bank in the Real World ( RW ) prior to the balancing date were not posted to Letman.

3. An error prior to the balancing date has been carried forward.

The balancing statement should therefore be prepared as close to the balancing date as possible.

Good practice would suggest a balancing statement should be prepared every month.

How to prepare a Balancing Statement

1. Pick the balancing date from the RW bank statement. If you do this once a month as advised, you should pick a balancing date from the last few days.

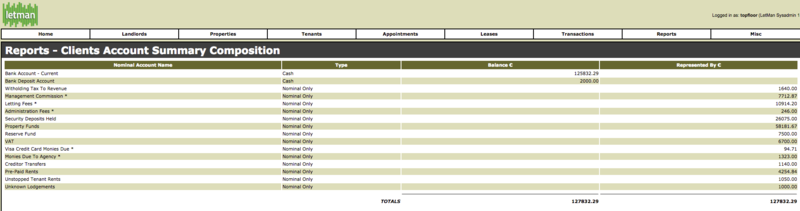

2. Print the Client Account Composition as below :

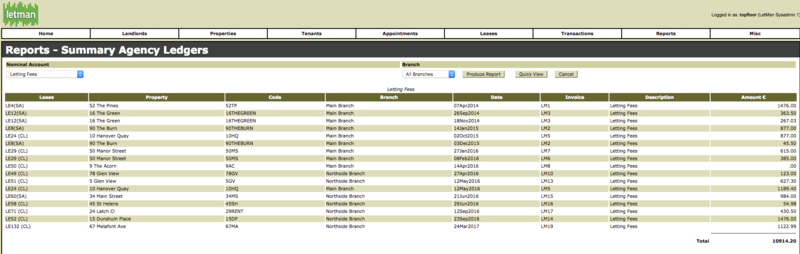

3. Print a breakdown of each of the items on the composition, for example Letting Fees as below…

4. Perform a Bank Reconciliation, entering the Real World Bank Balance as below ….

In order to demonstrate that the extraction and reconciliation procedures specified in Regulation 10(5) and (6) have been followed within the specified two month period, the PSP should sign and date the reconciliation and associated reports in respect of the balancing date.

If a difference is reported, it for either one of the following three reasons :

- Money was lodged to the RW bank account and not evidenced on Letman.

- Money was paid out of the RW bank account and not evidenced on Letman.

- A deficit has been carried forward.

The Accountant should extract from these Balancing Statements information for the Accountant’s Report. If there are differences to be explained, the Accountant will be relying on your explanation to decide whether the breach is trivial or not.

The Accountant should also conduct separate tests on various transactions to decide in their professional judgement whether the PSP is in compliance with the Client Accounting Regulations. In making that judgement, the Accountant can also consider whether the PSP has knowledge of the Regulations, the competence of accounts staff, the supervision of accounts staff by the PSP and past problems.